When your doctor prescribes a brand-name medication, but your insurance forces you to switch to a generic version - and you know it won’t work for you - you’re not alone. Every year, millions of people face this exact problem. Insurance companies use formularies and step therapy rules to cut costs, but sometimes those rules ignore real medical needs. The good news? You can fight back. And more than half the time, you win - if you know how to do it right.

Why Your Insurance Denies Generic Substitutions

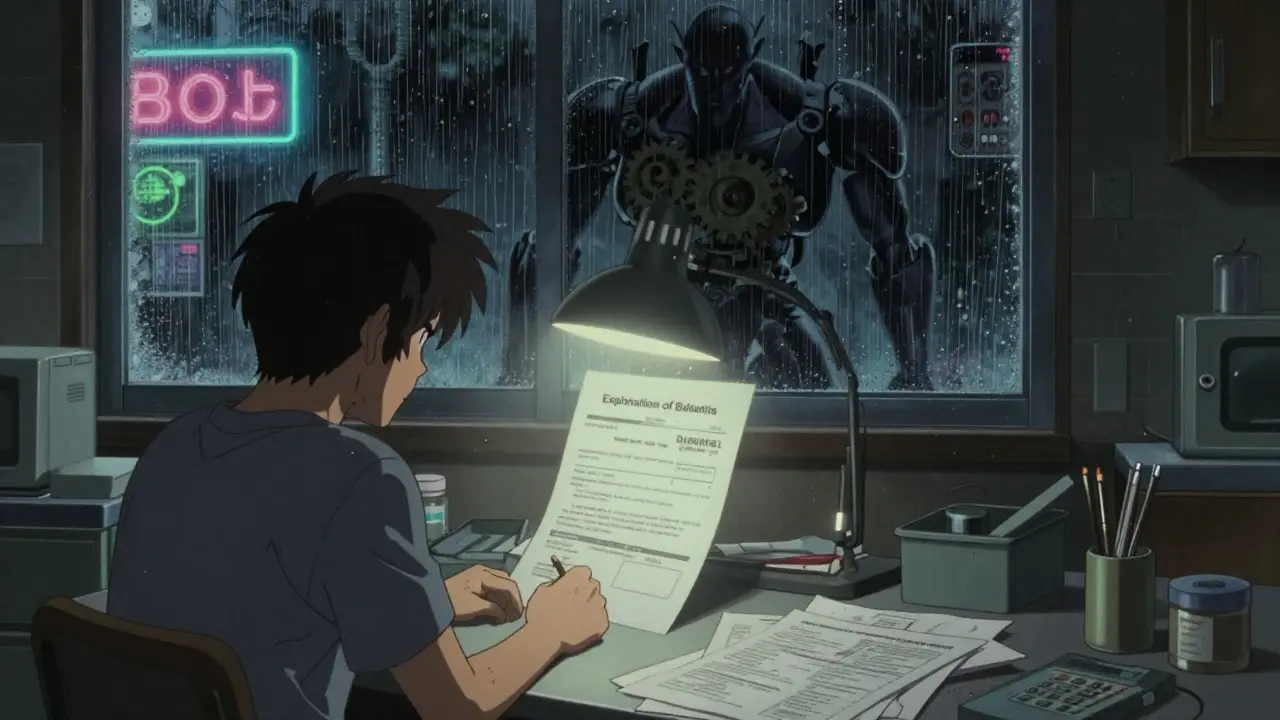

Insurance plans don’t deny brand-name drugs because they’re being cruel. They do it because they’re trying to save money. Generic medications cost up to 80% less than their brand-name equivalents. That’s why most plans require you to try the generic first. This is called step therapy. But not all patients respond the same way. Some have allergies. Others have had bad reactions. Some conditions, like epilepsy or thyroid disorders, need exact dosing that generics can’t reliably provide. According to the American Medical Association, 18.7% of all prior authorization requests are denied at first. But here’s what most people don’t know: 72% of those denials get overturned on appeal. That means if you’re denied, you have a very good chance of winning - if you follow the right steps.Step 1: Read Your Explanation of Benefits (EOB)

The first thing you need to do is find your Explanation of Benefits (EOB). This isn’t your bill. It’s the insurance company’s official letter explaining why they denied coverage. You’ll get this in the mail or through your online portal. Look for phrases like:- “Generic substitution required”

- “Step therapy protocol not completed”

- “Not medically necessary”

Step 2: Get a Letter of Medical Necessity from Your Doctor

This is the most important step. Without a strong letter from your doctor, your appeal will likely fail. The letter must include three things:- Why the brand-name drug is medically necessary - not just preferred

- Proof that you tried and failed the generic (or other alternatives)

- Clinical guidelines that support your doctor’s decision

Step 3: Complete the Official Appeal Form

Most insurers have a standard form for appeals. You can find it on their website or by calling customer service. Don’t just write a letter - fill out the form. It might seem bureaucratic, but it ensures your request gets routed correctly. If your doctor’s office doesn’t handle appeals, ask them to complete the form. Many practices now have staff trained to do this. The Crohn’s & Colitis Foundation found that 83% of successful appeals included a physician-completed form documenting prior treatment failures.Step 4: Request a Peer-to-Peer Review

This is the secret weapon. When your appeal is reviewed, the insurance company’s medical director will look at your file. But if your doctor asks for a peer-to-peer review, they can speak directly to the insurer’s doctor. This isn’t automatic. You have to ask for it in writing. Say: “I request a peer-to-peer clinical review between my prescribing physician and your medical director.” According to healthcare attorney Dr. Scott Glovsky, peer-to-peer reviews have a success rate over 75% when properly prepared. That’s because doctors understand doctors. A 15-minute phone call can fix what pages of paperwork can’t.

Step 5: Submit Everything on Time

Once your letter and form are ready, submit them. Send them by certified mail with return receipt - or upload them through the insurer’s secure portal. Keep copies of everything. Timeline matters:- Standard appeals: Insurer has 30 days to respond (60 days if you’re already on the medication)

- Expedited appeals: If your health is at risk (e.g., risk of hospitalization, worsening condition), you can request an urgent review. They must respond in 4 business days.

Step 6: File an External Review

If your internal appeal is denied, you can ask for an independent third party to review your case. This is called an external review. For commercial plans, this is handled by a state-appointed reviewer. For Medicare Part D, it’s done by an Independent Review Entity (IRE). Medicare’s external review stage has the highest overturn rate - 63.2%, according to CMS data. State Medicaid programs also offer external reviews, though timelines vary. You have 60 days from the internal denial notice to request an external review. You can file this yourself, but it helps to have your doctor’s support again. Some states, like California and New York, require insurers to complete peer reviews within 72 hours of request.What If You’re Still Denied?

If the external review fails, you still have options:- File a complaint with your state’s insurance department. California’s Department of Insurance resolves 92% of formal complaints within 30 days.

- Ask your doctor to write a letter to your employer’s HR department if you’re on a group plan.

- Use patient assistance programs from drug manufacturers. Many companies offer free or discounted brand-name drugs to those who qualify.

Common Mistakes That Kill Appeals

Most appeals fail for the same reasons:- Waiting too long to start - deadlines are strict

- Using vague language like “it’s better for me” instead of clinical facts

- Not documenting prior treatment failures

- Not asking for a peer-to-peer review

- Submitting incomplete forms or missing signatures

Real Cases That Won

One patient with Type 1 diabetes was denied semaglutide because her plan said insulin was “sufficient.” She provided:- 12 months of glucose logs showing dangerous lows on insulin

- Her endocrinologist’s letter citing ADA guidelines on GLP-1 agonists for high-risk patients

- Proof she’d tried three other oral meds without success

How to Speed Up the Process

- Use your insurer’s online portal. Digital submissions are processed faster. - Call customer service daily after submission. Ask for a case number and the name of the reviewer. - If you’re on Medicare, contact the Medicare Rights Center. They offer free counseling. - Ask your pharmacy to help. Many now have patient advocates on staff.What’s Changing in 2026

New rules are coming. In January 2024, the National Association of Insurance Commissioners updated its model law to require insurers to review step therapy exceptions within 48 hours if there’s documented adverse reaction. The Biden administration is also pushing to cut Medicare Part D appeal times from 7 days to 3 for urgent cases. More providers are using digital prior authorization systems. According to the AMA, 62% of doctors say these platforms have improved their appeal success rates.Final Tip: Don’t Go It Alone

You don’t need to be a lawyer or a doctor to win an appeal. You just need to be organized. Keep a folder with:- Copy of your EOB

- Doctor’s letter

- Completed appeal form

- Proof of prior medication failures (prescription records, lab results)

- Dates and names of every person you spoke with

Can I appeal if my insurance says the generic is just as good?

Yes. Insurance companies often claim generics are “clinically equivalent,” but that’s not always true. For medications like levothyroxine, warfarin, or certain epilepsy drugs, even small differences in formulation can cause serious side effects. Your doctor must document why the brand-name version is medically necessary - not just preferred. Clinical guidelines from the American College of Physicians or specialty societies can help prove this.

How long does an insurance appeal take?

Standard appeals take 30 days for new prescriptions or 60 days if you’re already taking the medication. Urgent cases must be decided in 4 business days. If you request an external review, it can take another 30 to 60 days. Some states, like New York, require faster reviews for step therapy exceptions. Always ask for a timeline in writing.

Do I need a lawyer to appeal?

No. Most people win appeals without legal help. The key is strong documentation from your doctor and following the insurer’s process exactly. However, if you’re denied at the external review stage and your condition is serious, you may want to consult a healthcare attorney - especially if you’re facing hospitalization or long-term harm.

What if my doctor won’t help me appeal?

Talk to the office manager or a nurse. Many practices now have patient advocates or billing specialists who handle appeals. If your doctor refuses, you can still submit a letter yourself explaining your history with the medication - but success rates drop sharply without clinical documentation. Consider switching to a provider who supports patient advocacy.

Can I appeal for a generic that’s not on the formulary?

Yes. Even if a generic is approved, your plan might not cover the specific brand or manufacturer you need. You can appeal for a non-formulary generic by showing it’s the only one that works for you - for example, if you’re allergic to an inactive ingredient in the covered version. Documentation of adverse reactions is critical here.

Will appealing affect my future coverage?

No. Filing an appeal is a protected right under the Affordable Care Act. Insurers cannot penalize you, raise your rates, or drop your coverage for appealing. In fact, insurers are required to report appeal outcomes to state regulators. Your record is confidential.

Are there free resources to help me appeal?

Yes. Every state has an insurance commissioner’s office that offers free help. The Medicare Rights Center provides free counseling for Part D enrollees. The Patient Advocate Foundation offers templates and step-by-step guides. Nonprofits like the Crohn’s & Colitis Foundation and T1D Exchange have patient success stories and templates you can adapt.

14 Comments

Ryan W January 25 2026

Let’s be real-this whole system is a scam designed to enrich Big Pharma and their insurance cronies. Step therapy? That’s just corporate greed dressed up as ‘cost containment.’ The AMA says 72% of appeals get overturned? That’s because the insurers know they’re violating ethical standards and they’re scared of the paperwork. But don’t expect Congress to fix it-lobbyists own every damn seat.

And don’t even get me started on how generics aren’t ‘clinically equivalent’ for levothyroxine. The FDA’s bioequivalence standards are a joke. 80-125% range? That’s not medicine, that’s Russian roulette with your thyroid.

They’re not saving money-they’re gambling with people’s lives. And if you’re poor, you die quietly. If you’re loud and literate, you win. That’s the American healthcare system in a nutshell.

Rakesh Kakkad January 26 2026

Respected author, your comprehensive exposition on the procedural architecture of insurance appeals is both methodical and commendable. However, I must underscore that the systemic inequities embedded within the U.S. healthcare financing model are not merely administrative but epistemological in nature. The commodification of pharmaceuticals as mere line items in actuarial tables negates the ontological reality of human physiology.

Furthermore, the reliance on physician-generated documentation as a gatekeeping mechanism reinforces a paternalistic hierarchy wherein the patient’s lived experience is subordinated to bureaucratic validation. One wonders whether the true solution lies not in appealing to broken systems, but in dismantling them entirely.

Nicholas Miter January 26 2026

Man, I’ve been through this three times with my thyroid med. The first time I just submitted the form and forgot about it-got denied. Second time I had my doc write a letter, asked for peer review, sent it certified mail. Got approved in 14 days.

Don’t overthink it. Just do the steps. Keep copies. Call every 3 days. The insurance reps don’t care, but they’ll move faster if they know you’re gonna keep bugging them.

And yeah, the generic *does* sometimes suck. My body just doesn’t process the filler in the Walmart brand. Weird, but true.

Suresh Kumar Govindan January 28 2026

This guide is a distraction. The real issue is that the U.S. government permits pharmaceutical monopolies under patent law while simultaneously outsourcing healthcare to private entities that profit from human suffering. The FDA’s approval of generics is a charade. The same manufacturers produce both brand and generic-identical factories, identical chemists, different labels.

They’re not saving money. They’re laundering profits. And you’re being told to jump through hoops while the real thieves laugh from their yachts in the Caymans.

George Rahn January 28 2026

They call it ‘step therapy’-but what it really is, is social Darwinism with a claims form. You’re not fighting for a pill. You’re fighting for the right to be treated as a person, not a cost center.

And let’s be honest: if you’re white, middle-class, and literate, you win. If you’re Black, poor, or don’t speak fluent bureaucratic, you die. That’s not a system failure. That’s the design.

They want you to think this is about paperwork. It’s not. It’s about power. And the only thing that scares them more than a patient who knows their rights… is a patient who knows their rights and has a lawyer.

Karen Droege January 29 2026

I’m a nurse practitioner and I help patients appeal every single week. I’ve seen people cry because they couldn’t afford their meds. I’ve seen elderly patients skip doses because they were afraid of the bill.

But here’s what I tell them: YOU ARE NOT ALONE. And you are NOT crazy for needing the brand name.

My favorite trick? I call the insurer’s medical director myself-just say, ‘I’m Dr. Droege, their provider, and I need to speak to your medical director about this case immediately.’ They always transfer me. Because guess what? Doctors talk to doctors. And they know when someone’s being treated like a number.

Don’t give up. Your life matters more than their profit margin.

Shweta Deshpande January 30 2026

This is such a helpful guide! I just got approved for my brand-name seizure med after 3 months of fighting. I didn’t know about peer-to-peer reviews-that was the game-changer for me. My neurologist called them directly and they approved it the next day.

Also, don’t be afraid to ask your pharmacist for help. Mine gave me a printed checklist of everything I needed and even helped me fill out the form. It felt so good to have someone in my corner.

And if your doctor seems overwhelmed, just say, ‘I know you’re busy, but can you just sign this one letter? It’ll change my life.’ Most of them will say yes. I promise.

You’ve got this. And if you need someone to cheer you on, I’m here. We’re all in this together.

Sally Dalton January 31 2026

thank you for this i was about to give up on my med but i just submitted my appeal using your steps and my doc wrote the letter and i asked for peer review and now i’m waiting… fingers crossed

i had no idea about the 72% overturn rate-i thought i was doomed. this gave me hope. also i spelled ‘generic’ wrong in my first draft and i was so embarrassed but then i realized… who cares? the docs don’t care about spelling, they care about the truth. so i just sent it anyway. lol

Shawn Raja February 2 2026

So let me get this straight-you’re telling me the solution to America’s broken healthcare system is… filling out forms?

That’s like telling someone drowning to just learn how to swim better.

Meanwhile, in Canada, they just give you the damn pill. No appeals. No letters. No ‘peer-to-peer’ negotiations. Just… medicine.

But hey, at least we get to feel like heroes for winning a bureaucratic game designed to make us suffer. Congrats, America. You turned healthcare into an obstacle course with a prize you’re not even sure you want anymore.

Dan Nichols February 3 2026

Most people don’t realize the real reason generics fail is because the inactive ingredients are different. That’s not a myth. That’s chemistry. I had a patient who went into anaphylaxis on a generic metformin because of a dye they put in it. The brand didn’t have it.

But you won’t hear that from the FDA or the insurers. They don’t want you to know. Because if you knew, you’d sue them. And they’d lose billions.

So they tell you to appeal. They know you’ll give up. And when you do? They win.

Renia Pyles February 3 2026

Ugh I’m so tired of this. I’ve been on this same med for 10 years. My insurance changed their formulary last year. Now I have to ‘prove’ I need it. Like I’m some kind of fraud.

My doctor wrote the letter. I sent everything. Got denied. Again. I called them 17 times. They said ‘we’re reviewing.’ What does that even mean? Review what? My suffering?

I’m not asking for luxury. I’m asking not to die. And they treat me like I’m trying to scam them.

I hate this system. I hate them. I hate that I have to beg for my own health.

Josh josh February 3 2026

just wanted to say this post saved my life. i got my brand name back after 6 months. i didnt even know about peer reviews. my doc did it and they approved it in 2 days. also i started calling the insurer every day and they finally got annoyed and approved it just to make me stop.

ps i spelled ‘medication’ wrong 3 times in my appeal but they still approved it. so dont stress the typos. just get it in.

bella nash February 5 2026

The institutionalized commodification of therapeutic intervention represents a profound epistemological rupture between clinical science and market logic. The imposition of step therapy protocols, while ostensibly grounded in cost-containment paradigms, functions as a mechanism of structural violence against chronically ill populations.

Moreover, the reliance on physician-generated documentation as a prerequisite for therapeutic access reinforces a heteronormative, technocratic hegemony wherein patient autonomy is subordinated to bureaucratic validation protocols.

The external review mechanism, while procedurally adequate, remains epistemologically constrained by its dependence on insurer-appointed entities. True justice requires systemic dismantling, not procedural accommodation.

Curtis Younker February 6 2026

I want to say thank you for this. I’ve been through this with my bipolar meds. The generic made me suicidal. I didn’t tell anyone. I was too ashamed.

Then I found this guide. I printed it out. My doctor cried when I showed him. He said he’d never seen a patient fight this hard.

We did the peer review. They approved it in 8 days.

I’m back to sleeping. I’m back to working. I’m back to being me.

So if you’re reading this and you’re scared? Don’t be. You’re not alone. And you’re not weak for asking for help.

Keep going. I’m rooting for you.